All Categories

Featured

Table of Contents

That usually makes them an extra cost effective choice for life insurance policy protection. Several people obtain life insurance protection to help monetarily protect their loved ones in instance of their unexpected fatality.

Or you might have the option to convert your existing term coverage right into a long-term plan that lasts the rest of your life. Different life insurance policy plans have possible advantages and drawbacks, so it's crucial to understand each prior to you determine to buy a policy.

As long as you pay the costs, your recipients will certainly receive the survivor benefit if you pass away while covered. That said, it is very important to note that a lot of plans are contestable for 2 years which means protection can be retracted on fatality, needs to a misstatement be discovered in the app. Policies that are not contestable typically have a rated death benefit.

What Is 20-year Level Term Life Insurance? The Complete Overview?

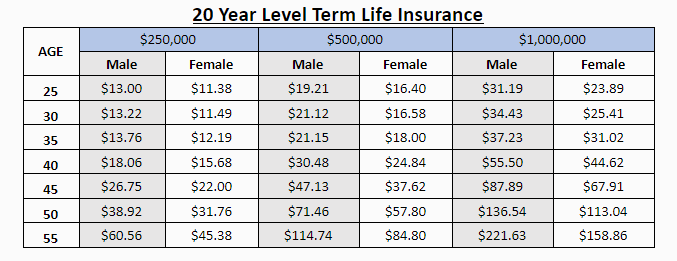

Premiums are usually less than whole life policies. With a level term plan, you can select your protection quantity and the plan length. You're not locked right into a contract for the rest of your life. Throughout your plan, you never ever have to stress over the costs or death benefit quantities changing.

And you can't squander your policy throughout its term, so you will not obtain any kind of economic advantage from your past protection. As with various other kinds of life insurance policy, the expense of a level term policy relies on your age, coverage demands, work, way of life and health. Usually, you'll find more inexpensive coverage if you're younger, healthier and much less dangerous to insure.

Since degree term costs stay the exact same for the duration of insurance coverage, you'll understand specifically how much you'll pay each time. Degree term protection also has some flexibility, allowing you to tailor your policy with added attributes.

What You Should Know About Level Term Life Insurance

You might need to meet specific problems and qualifications for your insurance firm to enact this motorcyclist. Additionally, there may be a waiting period of up to 6 months prior to working. There likewise could be an age or time limit on the insurance coverage. You can add a kid motorcyclist to your life insurance coverage policy so it also covers your children.

The survivor benefit is typically smaller sized, and protection generally lasts till your youngster transforms 18 or 25. This rider might be a more economical way to aid guarantee your youngsters are covered as cyclists can commonly cover numerous dependents simultaneously. Once your child ages out of this insurance coverage, it might be feasible to convert the motorcyclist into a brand-new plan.

The most typical kind of irreversible life insurance is entire life insurance, however it has some key differences contrasted to level term protection. Below's a standard introduction of what to consider when contrasting term vs.

What is the Role of Level Benefit Term Life Insurance?

Whole life insurance lasts insurance policy life, while term coverage lasts protection a specific period. The premiums for term life insurance are commonly lower than whole life coverage.

One of the main features of degree term insurance coverage is that your premiums and your survivor benefit do not alter. With lowering term life insurance policy, your premiums continue to be the same; however, the fatality advantage quantity obtains smaller gradually. You might have insurance coverage that begins with a death advantage of $10,000, which might cover a home loan, and after that each year, the death advantage will decrease by a collection amount or percentage.

Due to this, it's usually an extra cost effective type of degree term insurance coverage., yet it may not be enough life insurance for your demands.

Is Term Life Insurance a Good Option for You?

After choosing on a plan, complete the application. If you're approved, sign the documents and pay your very first premium.

Lastly, think about scheduling time yearly to examine your plan. You may want to update your recipient info if you have actually had any kind of substantial life changes, such as a marital relationship, birth or divorce. Life insurance policy can often feel challenging. However you do not need to go it alone. As you explore your choices, consider discussing your requirements, wants and worries with a financial expert.

No, degree term life insurance coverage doesn't have cash worth. Some life insurance policy policies have an investment attribute that allows you to construct money worth in time. A portion of your premium settlements is established aside and can earn rate of interest with time, which grows tax-deferred throughout the life of your protection.

Nonetheless, these plans are frequently substantially more pricey than term protection. If you reach the end of your plan and are still alive, the insurance coverage finishes. You have some alternatives if you still want some life insurance policy coverage. You can: If you're 65 and your protection has actually gone out, as an example, you may intend to get a brand-new 10-year degree term life insurance policy policy.

What is Life Insurance Level Term? How It Works and Why It Matters?

You might be able to convert your term protection into an entire life policy that will certainly last for the rest of your life. Many sorts of level term policies are convertible. That implies, at the end of your protection, you can transform some or all of your plan to entire life insurance coverage.

A degree costs term life insurance strategy allows you stick to your spending plan while you help secure your household. ___ Aon Insurance Solutions is the brand name for the brokerage and program administration procedures of Affinity Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Firm, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Policy Solutions Inc.; in CA, Aon Fondness Insurance Policy Providers, Inc .

Latest Posts

Companies That Offer Funeral Plans

2021 State Regulated Program For Final Expenses

Final Expense Hotline