All Categories

Featured

Table of Contents

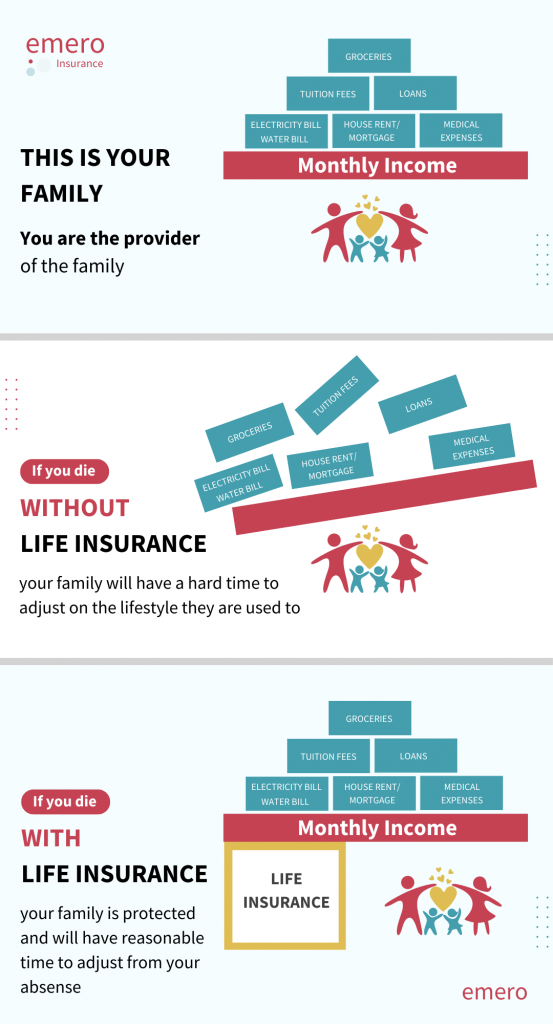

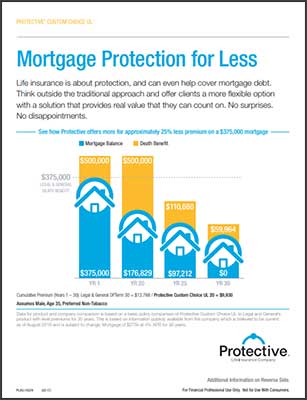

Nevertheless, keeping every one of these phrases and insurance coverage kinds directly can be a headache - mortgage life insurance scam. The complying with table puts them side-by-side so you can swiftly separate among them if you obtain perplexed. An additional insurance policy protection kind that can repay your home loan if you pass away is a basic life insurance policy policy

A is in location for an established number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away throughout that term. A provides insurance coverage for your whole life period and pays out when you pass away.

One typical general rule is to go for a life insurance policy plan that will certainly pay out as much as 10 times the insurance policy holder's wage amount. You might select to utilize something like the Dollar method, which adds a family members's debt, income, home loan and education expenditures to compute just how much life insurance coverage is required.

It's also worth noting that there are age-related limits and limits imposed by virtually all insurers, that typically will not provide older buyers as many choices, will bill them much more or may refute them outright.

Right here's how home loan protection insurance policy measures up versus basic life insurance. If you're able to certify for term life insurance, you need to stay clear of home mortgage protection insurance coverage (MPI).

In those scenarios, MPI can supply great peace of mind. Every home loan protection choice will certainly have numerous guidelines, policies, benefit choices and downsides that require to be considered meticulously against your specific scenario.

Loan Repayment Protection Insurance

A life insurance policy plan can help repay your home's home mortgage if you were to pass away. It is among numerous methods that life insurance may aid shield your loved ones and their monetary future. One of the most effective means to factor your home loan into your life insurance policy demand is to speak with your insurance policy agent.

Instead of a one-size-fits-all life insurance policy, American Family members Life Insurance provider supplies policies that can be made especially to satisfy your family's requirements. Here are a few of your alternatives: A term life insurance coverage policy. do you have to pay for mortgage insurance is active for a specific quantity of time and usually offers a bigger quantity of coverage at a lower cost than an irreversible plan

Rather than only covering an established number of years, it can cover you for your whole life. It also has living advantages, such as money value accumulation. * American Family Members Life Insurance Firm uses different life insurance policy policies.

They may also be able to aid you discover voids in your life insurance policy coverage or brand-new means to save on your other insurance policies. A life insurance policy recipient can select to use the death benefit for anything.

Life insurance coverage is one method of aiding your family members in repaying a home loan if you were to die prior to the home mortgage is entirely paid back. No. Life insurance policy is not compulsory, but it can be a vital part helpful make sure your loved ones are economically protected. Life insurance policy earnings may be used to assist pay off a home loan, yet it is not the like home mortgage insurance policy that you may be needed to have as a condition of a finance.

Home Life Insurance Policy

Life insurance may help guarantee your home stays in your household by providing a fatality advantage that might help pay down a home mortgage or make crucial acquisitions if you were to pass away. Contact your American Family Insurance coverage representative to talk about which life insurance coverage plan best fits your demands. This is a brief description of protection and undergoes plan and/or cyclist terms, which might vary by state.

The words life time, lifelong and irreversible go through plan terms and problems. * Any type of car loans drawn from your life insurance policy policy will accumulate interest. private mortgage insurance protects who. Any type of superior finance balance (finance plus passion) will be subtracted from the survivor benefit at the time of insurance claim or from the money worth at the time of surrender

** Based on plan terms. ***Price cuts may differ by state and company underwriting the auto or home owners plan. Price cuts may not put on all coverages on an automobile or homeowners plan. Discount rates do not put on the life plan. Plan Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage security insurance coverage (MPI) is a various sort of secure that could be helpful if you're not able to settle your mortgage. While that additional security appears great, MPI isn't for every person. Below's when mortgage defense insurance coverage is worth it. Home loan security insurance policy is an insurance coverage that pays off the rest of your mortgage if you pass away or if you become handicapped and can't work.

Like PMI, MIP shields the loan provider, not you. Nevertheless, unlike PMI, you'll pay MIP throughout of the financing term, most of the times. Both PMI and MIP are needed insurance coverage protections. An MPI policy is completely optional. The amount you'll spend for home mortgage protection insurance relies on a range of elements, including the insurance provider and the current balance of your home mortgage.

Still, there are benefits and drawbacks: Many MPI policies are issued on a "assured acceptance" basis. That can be advantageous if you have a wellness condition and pay high prices forever insurance policy or struggle to get coverage. mortgage protection center scam. An MPI policy can supply you and your family members with a feeling of protection

Insurance On Mortgage

It can also be valuable for people who do not get or can not pay for a typical life insurance plan. You can select whether you require home loan protection insurance policy and for the length of time you require it. The terms typically vary from 10 to 30 years. You may want your home mortgage defense insurance policy term to be close in length to the length of time you have actually entrusted to settle your home mortgage You can terminate a home mortgage protection insurance coverage plan.

Latest Posts

Companies That Offer Funeral Plans

2021 State Regulated Program For Final Expenses

Final Expense Hotline